DORA

Digital Operational Resilience Act

Achieve operational robustness with DORA compliance

Break down the complexity and get a good start on compliance requirements with a structured approach that ensures internal anchoring across the organization.

Enhanced digital resilience requirements

On January 16, 2023, the EU's digital operational resilience (DORA) regulation came into force to address the growing risks associated with digitalization and cyber threats in the financial sector. DORA establishes new frameworks for IT and cybersecurity monitoring and regulation across the EU's financial landscape.

With RISMA, you gain a robust compliance solution for visualising tasks, documenting information, and efficiently managing ICT events and third-party contracts.

Seamless DORA implementation

Navigate safely through the implementation of the directive and meet regulatory requirements and ICT best practices.

The DORA solution, continuously updated with expert insights from Plesner Law Firm, ensures you stay informed of the latest changes and maintain peak operational resilience.

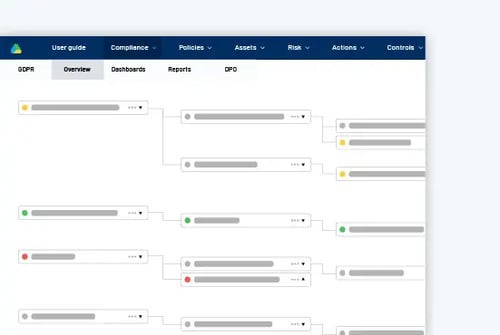

Compliance-ready documentation

Centralize all compliance information and documentation in one place to streamline regulatory authority inspections, saving valuable time and resources.

Our efficient documentation process ensures you can easily demonstrate compliance with the regulation.

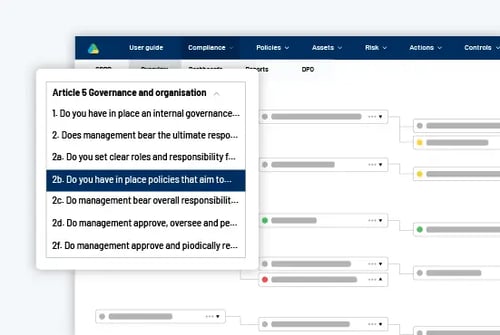

Strengthen internal anchoring

Share knowledge across the organization to keep all stakeholders informed, engaged, and aligned with common goals. This enhances internal cohesion and significantly boosts the organization's capability to implement and maintain compliance requirements effectively.

Achieve error-free reporting with a structured DORA Register

Prepare your DORA register of information without errors and rejections. Get

a structured, guided solution that ensures correct data formatting, automated

validation, and smooth reporting without Excel chaos.

Structured and compliant DORA registration

Automated data validation

Key features in our DORA solution

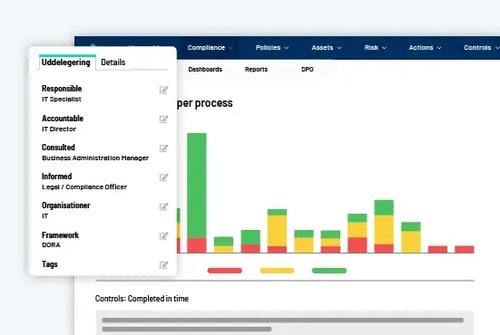

A GRC platform to bring the organization together

Power your organisation by connecting data, teams, action and reporting in an integrated GRC platform. Whether you deploy one, two, or all our solutions, RISMA GRC platform provides great value by boosting collaboration, increasing visibility, and saving time for everyone involved.

-

Internal audit streamlined

-

Effortlessly automate, document and report all your controls - including assessment, mitigation and monitoring in one simple platform.

-

Risk management organized

-

Define, assess, analyze and mitigate your organization’s risks and turn your insight into strategic assets.

-

Information security systemized

-

Systematize your information security and achieve full ISMS compliance – including visual overview, real-time mentoring, built-in risk assessment and seamless reporting.

FAQ

What are DORA's cybersecurity requirements for financial entities?

DORA imposes extensive requirements on how companies within the financial sector and providers of information and communication technology (ICT) services strengthen their digital operational resilience.

The regulation sets minimum requirements within five categories:

- Governance and risk management: DORA requires companies to implement appropriate policies and guidelines to manage risks effectively.

- Incident reporting: Companies must log and assess ICT-related incidents to ensure effective management.

- Testing, preparation, and mitigation: Annual testing of ICT systems is mandatory, along with regular threat-led penetration testing (TLPT) of ICT services.

- Third-party risk management: Companies must monitor risks related to third-party providers, report outsourcing changes, manage risks associated with subcontracting, and ensure clear contracts for monitoring and availability.

- Information sharing: Financial entities are required to share information about cyber threats with other organizations and accept anonymized threat intelligence from supervisory authorities.

How can your solution support DORA compliance?

Our solution supports your organization’s DORA compliance journey by bringing governance, risk management, and compliance together in a platform. You'll get access to tools for:

- Risk assessment: Identify, assess, and manage risks to enable informed decision-making and prompt response to potential threats.

- Incident management: Register, categorize, and analyze incidents efficiently—helping implement necessary measures and support reporting.

- Vendor management: Monitor and manage your third-party vendors in alignment with DORA requirements, ensuring you can document your efforts to minimize external risks.

- Documentation and follow-up: Record and archive all processes and decisions to enable continuous follow-up, reduce complexity, and improve DORA compliance.

Can the DORA information register be exported from your solution for submission to FIONA?

Yes, with the help of our solution you can create and maintain the ICT required by DORA. You can export the register in Excel, CSV, or XML formats, making it simple to submit through FIONA Online. This streamlines your reporting process and ensures your organization remains fully compliant with DORA’s requirements.